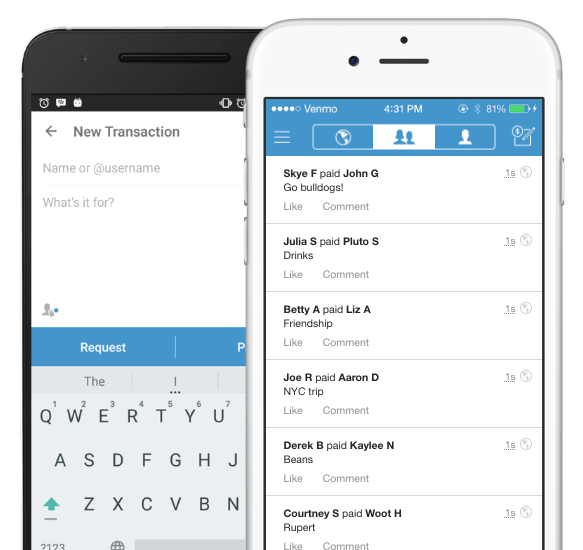

We started using Venmo in 2018 as an easy way to securely send and receive money to pay freelancers, friends and family, and yes, even split the bill of a lunch if one of us does not have cash on hand. It has been simple to use the money exchanging app and we will continue to use it next to other apps like Cash App and Paypal App.

Just this week, Venmo updated their policies to better serve its users. Below are the new updates and changes as from Venmo themselves.

| We’re writing about a few changes to our User Agreement that will be effective for you on January 24, 2019. In addition to the below changes, we’re reorganizing the content of the User Agreement.

Please review these updates and familiarize yourself with the changes being made. If you do not agree to these changes, you may close your account before January 24, 2019.

Changes include, among others: |

|

| • |

|

Updating the Venmo Protected Purchase Program (previously named Authorized Merchant Payment Protection) to include unusable items as potentially eligible for protection and to exclude payments sent using a bill payment service. |

|

|

|

|

|

| • |

|

We’re changing the actions that we may take if you engage in any restricted activities to include refusing to provide other PayPal services to you in the future, holding money sent to you for up to 180 days if you have violated our Acceptable Use Policy, and suspending your eligibility for the Venmo Protected Purchase Program. We’re also explaining that if you violate our Acceptable Use Policy, you’re responsible for any damages caused by the violation. |

|

|

| • |

|

We’re clarifying that we may set off any amounts you owe to us from other accounts you have with PayPal. |

|

|

| • |

|

We’re further explaining that the amount of any invalidated payment (plus any applicable fees) may be recovered from the sender or the recipient (for example, by holding the sender liable or reversing the payment from the recipient’s account). |

|

|

| • |

|

We’re clarifying that you may not be able to close your Venmo account if you have an open dispute or claim, or amounts owed to us. |

|

|

| • |

|

We’re clarifying that we may take up to 90 days to investigate whether an error has occurred on a new account, and, if we determine an error occurred, that we may take up to 20 Business Days to credit such accounts. |

|

|

| – The Venmo Team |

|

| Venmo is a service of PayPal, Inc., a licensed provider of money transfer services. All money transmission is provided by PayPal, Inc. pursuant to PayPal, Inc.’s licenses.

PayPal is located at 2211 N. First Street, San Jose, CA 95131 |